Revolut, established in 2015, has rapidly become a leading neobank, offering a suite of digital banking services tailored for modern financial needs. With a user-friendly mobile application, Revolut provides seamless international transactions, competitive exchange rates, and a variety of account options to suit individual preferences.

Types of Revolut Personal Accounts

Revolut offers several personal account options to cater to diverse user requirements:

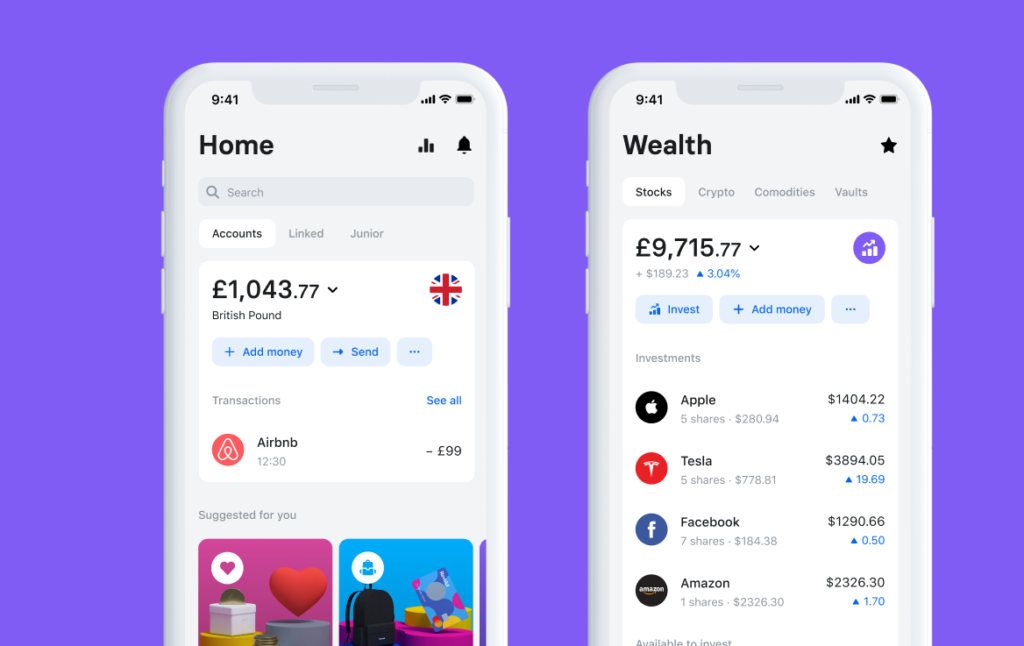

- Standard Account: A free account providing essential banking features, including currency exchange, budgeting tools, and a physical debit card.

- Plus Account: For £2.99 per month, this plan includes all Standard features plus additional benefits like purchase protection and priority customer support.

- Premium Account: At £6.99 per month, it offers all Plus features along with higher currency exchange limits, overseas medical insurance, and access to exclusive cards.

- Metal Account: Priced at £12.99 per month, this top-tier plan includes all Premium features, a concierge service, cashback on purchases, and a premium metal card.

Eligibility Criteria

To open a Revolut personal account in the UK, applicants must meet the following criteria:

- Age Requirement: Individuals must be at least 18 years old.

- Residency: Legal residents of the UK are eligible.

- Supported Countries: Revolut supports residents from various countries, including the UK, the US, Australia, Canada, Singapore, Switzerland, Japan, and the European Economic Area (EEA). Wise

Required Documentation

Applicants are required to provide:

- Proof of Identity: A valid government-issued photo ID, such as a passport or driver’s license.

- Proof of Address: Documents like utility bills or bank statements displaying the applicant’s current UK address.

- Selfie Verification: A live photo to verify identity. Revolut Help Centre

Step-by-Step Account Opening Process

- Download the Revolut App: Available on both the App Store and Google Play Store.

- Register Your Mobile Number: Enter a valid UK mobile number to receive a verification code.

- Provide Personal Information: Submit your full name, date of birth, residential address, and email address.

- Verify Identity: Upload the required identification documents and complete the selfie verification process.

- Select an Account Plan: Choose from Standard, Plus, Premium, or Metal plans based on your needs.

- Top-Up Your Account: Add funds using a debit card or bank transfer to activate your account.

- Order a Physical Card: Request a physical debit card for in-store purchases and ATM withdrawals.

Account Features and Benefits

- Multi-Currency Accounts: Hold and exchange multiple currencies at interbank rates.

- Budgeting Tools: Track spending, set budgets, and analyze expenses within the app.

- Security Features: Instantly freeze/unfreeze cards, set spending limits, and receive real-time transaction notifications.

- Open Banking Integration: Link external bank accounts for consolidated financial management. Revolut

Fees and Charges

- Standard Account: No monthly fees; however, certain services may incur charges.

- Plus Account: £2.99 per month.

- Premium Account: £6.99 per month.

- Metal Account: £12.99 per month.

Additional fees may apply for services such as international money transfers, ATM withdrawals beyond free limits, and currency exchanges exceeding monthly allowances.

Customer Support

Revolut offers customer support through the in-app chat feature, providing assistance for any account-related queries.

Conclusion

Opening a Revolut personal account in the UK is a straightforward process that can be completed within minutes via the mobile app. With a range of account options and features designed to cater to various financial needs, Revolut presents a compelling alternative to traditional banking.

Join the Revolution: Experience Financial Freedom with Revolut

In today’s rapidly evolving financial landscape, embracing innovative solutions is essential. Revolut, a leading global financial superapp, has garnered the trust of over 50 million users worldwide as of November 2024.

Statista By joining Revolut, you become part of a community that values seamless, efficient, and user-friendly financial services.

Why Choose Revolut?

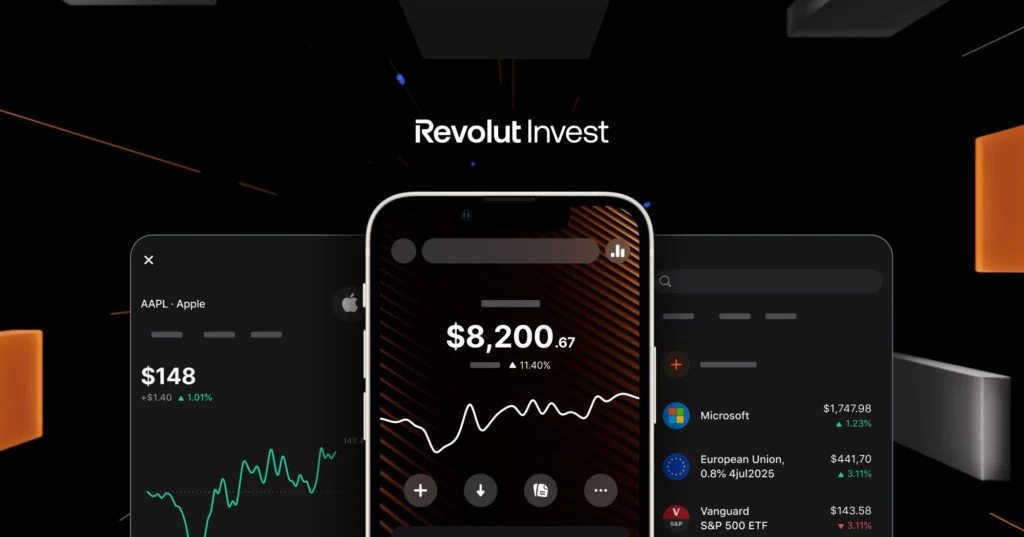

- Comprehensive Financial Services: Revolut offers a wide array of services, including currency exchange, cryptocurrency trading, stock investments, and budgeting tools, all within a single app.

- Global Reach: With operations in over 38 countries, Revolut provides consistent and reliable services to a diverse user base. The Times

- User-Centric Design: The platform is designed with the user in mind, ensuring intuitive navigation and personalized financial insights.

Exclusive Referral Program

Revolut’s referral program is a testament to its commitment to rewarding loyal users. By signing up through the referral link provided, you unlock exclusive benefits:

- Mutual Rewards: Both you and the referrer can earn bonuses upon meeting specific criteria, such as completing account verification and making qualifying transactions. Revolut

- Transparent Terms: Revolut ensures clarity in its referral program, with detailed terms and conditions available for users to review. Revolut

Revolut’s Impressive Growth Trajectory

Revolut’s exponential growth is a reflection of its innovative approach and user satisfaction:

- Revenue Milestones: In 2023, Revolut’s revenue surged by 95% to reach $2.2 billion, showcasing its expanding influence in the financial sector. PYMNTS

- Profitability: The company reported a record net profit of $545 million in 2023, underscoring its robust financial health. Revolut

- Customer Base Expansion: Revolut’s user base doubled between 2022 and 2024, reaching 50 million users in November 2024. Statista

Innovative Features and Services

Revolut continually enhances its offerings to meet the diverse needs of its users:

- Revolut <18: A tailored account for younger users, promoting financial literacy and independence. The referral program for Revolut <18 allows users to earn up to £50 annually by inviting friends. Revolut

- Ultra Membership: Launched in 2023, this premium tier offers exclusive benefits, including the best rates, lowest fees, unlimited airport lounge access, and subscriptions to premium services. Wikipedia

- Local IBANs: To enhance user experience, Revolut has introduced local IBANs in countries like Ireland, France, Netherlands, and Spain, facilitating seamless local transactions. Wikipedia

Security and Trust

Revolut prioritizes the security of its users’ funds and data:

- Regulatory Compliance: The company is authorized to offer cryptocurrency products and services in the UK, adhering to stringent regulatory standards. Wikipedia

- Banking License: In July 2024, Revolut secured a UK banking license, further solidifying its commitment to providing secure and reliable banking services. Wikipedia

Join the Community

By signing up with Revolut through the referral link https://revolut.com/referral/?referral-code=mianamfinh!DEC1-24-VR-GB, you align yourself with millions who have chosen a smarter way to manage their finances. Experience the benefits of a platform that is continually evolving to meet your financial needs.

Conclusion

Revolut stands at the forefront of financial innovation, offering a comprehensive suite of services that cater to the modern user’s needs. Its impressive growth, commitment to security, and user-centric approach make it a compelling choice for those seeking to revolutionize their financial journey. Join the millions who have already discovered the advantages of Revolut and take control of your financial future today.